FinTech, shortened form of Financial Technology, is a fast-rising industry that drives asset and wealth management through technology. Financial Services clients are looking at technology to do more, such as improve efficiency or offer new products and services. We bring together our financial services technology capabilities to support our clients through their transformative digital journey and introduce them to innovative macroeconomic trends. At Jasmine Ridge, our vision is to partner with Financial Services firms starting right from identifying the impediments, selecting the effective business model, and by proposing technology solutions for a scaled-up digital transformation.

We aim to develop the most impactful and innovative global financial services technology platforms. Our strong experience in the financial services sector has allowed us to develop a thorough understanding of the current trends as well as the challenges faced by financial institutions.

Security is imperative. Jasmine Ridge drives innovation in identity and document verification through facial recognition technology.

Evaluating credit risk models using Machine Learning and AI.

Blockchain technology effectively manages immutable, write-only transaction ledgers through cryptographic security and digital signatures.

Through data analytics, we diagnose user behavior to identify potential loan defaulters, minimizing risk in unsecured personal lending.

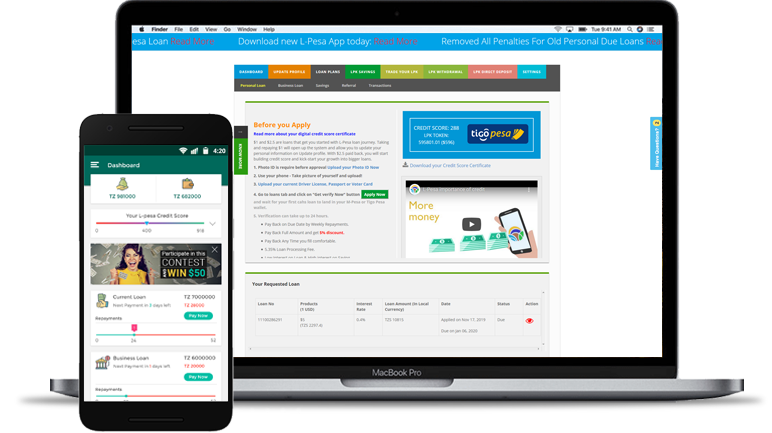

L-Pesa Microfinance leverages technology to provide microlending services in developing countries like Tanzania, Kenya, and Uganda. Their proprietary credit scoring model, developed by us, facilitates the rapid scaling of microlending by combining user behavior with traditional and alternative credit data. L-Pesa utilizes Amazon Web Services (AWS) for its highly scalable on-demand cloud computing platform. They provide convenient mobile money access for its clients by partnering with major mobile money providers like M-Pesa, Airtel Money, and Tigo Pesa, offering extensive reach to potential borrowers. Our FS technology expertise empowered L-Pesa to overcome challenges, including developing a unique credit scoring model.